- March 23, 2024

- Posted by: Gunjan Kapoor

- Category: Blog

“DIRECT CREDIT: Your channel to EQUITY FINANCE”

When we talk equity finance, it works as a powerful tool for businesses to access capital by capitalizing the value of their equity. At Direct Credit, we are specialized in providing tailored equity finance solutions to help our clients unlock their financial potential. Let us understand more about equity finance and how Direct Credit can assist you in achieving your financial goals.

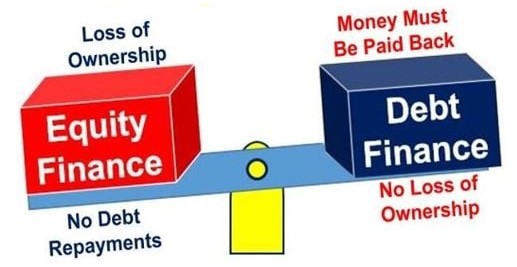

Equity finance involves raising capital by selling a stake in your business or utilizing the value of your assets, such as shares, as collateral. Equity finance allows investors to become partial owners of the business in exchange for funding. This can be in the form of equity crowd funding, venture capital investment, or private equity financing.

WHY DIRECT CREDIT?

Direct Credit offers range of equity finance solutions to meet the diverse needs of our clients. If you’ve a startup and you are looking for capital or an established business looking for expansion of your business, our team of experts is here to help you with equity finance landscape. We provide personalized guidance and support throughout the process and ensure that you secure the funding to fuel your growth and success in your business.

Benefits of Equity Finance with Direct Credit

- No Debt Obligations: Equity finance does not require borrowers to repay the capital with interest. Instead, investors receive a part of ownership in the business, and returns are based on the company’s performance.

- Long-Term Partnership: Equity finance involves forming of long-term partnerships with investors who have a lot of interest in the success of the business. This can provide valuable expertise, resources, and networking opportunities to support your growth objectives.

- Flexibility: Equity finance offers flexibility in terms of repayment, as there are no fixed repayment schedules or interest payments. This allows businesses to allocate their resources more efficiently and focus on driving growth without the burden of any debt obligations.

- Access to Capital: Equity finance provides access to capital without the need for collateral or any strong credit history. This makes it an attractive option for startups and early-stage companies that may not qualify for traditional bank loans.

Whether you’re an emerging entrepreneur with a ground breaking idea or an established business poised for expansion, we have the expertise and resources to support your growth journey. At Direct Credit, we are here to help you unlock your full financial potential through tailored equity finance solutions. Our team of experienced professionals will work closely with you to understand your unique needs and objectives, and develop a customized equity finance strategy that aligns with your goals, ensuring a seamless and successful fundraising process.

If you’re ready to take your business to the next level and unlock your full financial potential, contact ‘DIRECT CREDIT’ TODAY!

To learn more about our equity finance solutions. With our expertise and dedication, we’ll help you secure the funding you need to fuel growth, drive innovation, and achieve lasting success. CONTACT US NOW! – 9315530445